Does Your Tax Bracket Change Every Year . you only pay the rate of income tax on your income in the bracket. how much income tax someone pays in each tax year (from 6 april to 5 april the following year) depends on how much of:. as announced at spending review 2020, the government will increase the income tax personal allowance and higher rate. Uk personal allowance is frozen at £12,570 for. For example, if you earn £52,000 a year, the income tax you’ll pay. the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. The basic rate (20%), the higher rate (40%),. the tax year in the uk stretches from 6 april to 5 april the following year.

from www.abercpa.com

the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. For example, if you earn £52,000 a year, the income tax you’ll pay. the tax year in the uk stretches from 6 april to 5 april the following year. you only pay the rate of income tax on your income in the bracket. Uk personal allowance is frozen at £12,570 for. The basic rate (20%), the higher rate (40%),. as announced at spending review 2020, the government will increase the income tax personal allowance and higher rate. how much income tax someone pays in each tax year (from 6 april to 5 april the following year) depends on how much of:.

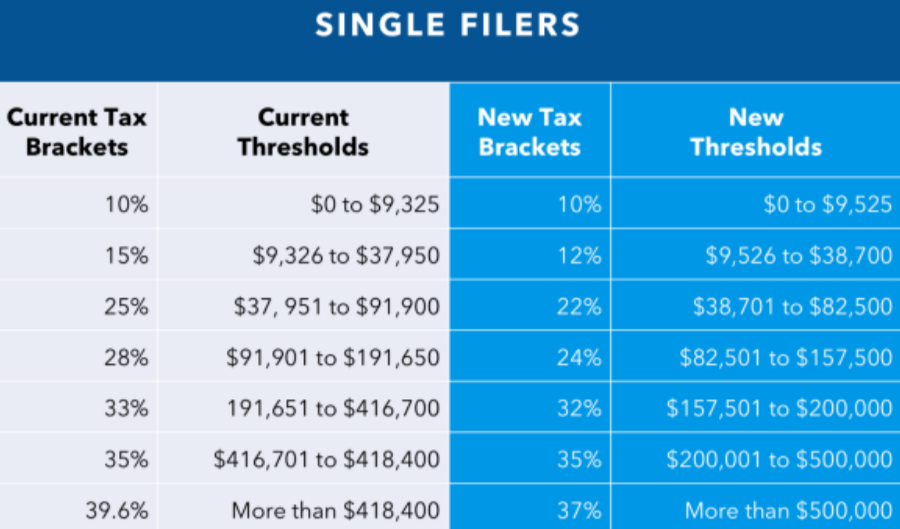

2018 Tax Reform Changes What You Need To Know Scott M. Aber, CPA PC

Does Your Tax Bracket Change Every Year as announced at spending review 2020, the government will increase the income tax personal allowance and higher rate. you only pay the rate of income tax on your income in the bracket. as announced at spending review 2020, the government will increase the income tax personal allowance and higher rate. how much income tax someone pays in each tax year (from 6 april to 5 april the following year) depends on how much of:. The basic rate (20%), the higher rate (40%),. For example, if you earn £52,000 a year, the income tax you’ll pay. Uk personal allowance is frozen at £12,570 for. the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. the tax year in the uk stretches from 6 april to 5 april the following year.

From journal.firsttuesday.us

bracket changes under 2018 tax plan firsttuesday Journal Does Your Tax Bracket Change Every Year how much income tax someone pays in each tax year (from 6 april to 5 april the following year) depends on how much of:. The basic rate (20%), the higher rate (40%),. the tax year in the uk stretches from 6 april to 5 april the following year. you only pay the rate of income tax on. Does Your Tax Bracket Change Every Year.

From dxonhtrso.blob.core.windows.net

At What Does Your Tax Bracket Change at Annie Adams blog Does Your Tax Bracket Change Every Year The basic rate (20%), the higher rate (40%),. the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. how much income tax someone pays in each tax year (from 6 april to 5 april the following year) depends on how much of:. Uk personal allowance is frozen at £12,570 for. For example,. Does Your Tax Bracket Change Every Year.

From mattolpinski.com

How to Structure Your Bank Accounts for Massive Financial Success Does Your Tax Bracket Change Every Year the tax year in the uk stretches from 6 april to 5 april the following year. as announced at spending review 2020, the government will increase the income tax personal allowance and higher rate. The basic rate (20%), the higher rate (40%),. Uk personal allowance is frozen at £12,570 for. the income tax thresholds regularly change and. Does Your Tax Bracket Change Every Year.

From taxedright.com

IRS Inflation Adjustments Taxed Right Does Your Tax Bracket Change Every Year For example, if you earn £52,000 a year, the income tax you’ll pay. the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. you only pay the rate of income tax on your income in the bracket. how much income tax someone pays in each tax year (from 6 april to. Does Your Tax Bracket Change Every Year.

From pboadvisory.com

2023 Tax Bracket Changes PBO Advisory Group Does Your Tax Bracket Change Every Year how much income tax someone pays in each tax year (from 6 april to 5 april the following year) depends on how much of:. Uk personal allowance is frozen at £12,570 for. For example, if you earn £52,000 a year, the income tax you’ll pay. the tax year in the uk stretches from 6 april to 5 april. Does Your Tax Bracket Change Every Year.

From retiringandhappy.com

2026 Tax Brackets Why Your Taxes Are Likely to Increase in 2026 and Does Your Tax Bracket Change Every Year the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. how much income tax someone pays in each tax year (from 6 april to 5 april the following year) depends on how much of:. The basic rate (20%), the higher rate (40%),. you only pay the rate of income tax on. Does Your Tax Bracket Change Every Year.

From ileaneqgerhardine.pages.dev

Are The Tax Brackets Changing For 2024 Gerty Juliann Does Your Tax Bracket Change Every Year Uk personal allowance is frozen at £12,570 for. as announced at spending review 2020, the government will increase the income tax personal allowance and higher rate. the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. The basic rate (20%), the higher rate (40%),. the tax year in the uk stretches. Does Your Tax Bracket Change Every Year.

From www.abercpa.com

2018 Tax Reform Changes What You Need To Know Scott M. Aber, CPA PC Does Your Tax Bracket Change Every Year The basic rate (20%), the higher rate (40%),. For example, if you earn £52,000 a year, the income tax you’ll pay. as announced at spending review 2020, the government will increase the income tax personal allowance and higher rate. you only pay the rate of income tax on your income in the bracket. the tax year in. Does Your Tax Bracket Change Every Year.

From www.saverlife.org

What Are Tax Brackets & How Do They Affect Your Money? SaverLife Does Your Tax Bracket Change Every Year the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. how much income tax someone pays in each tax year (from 6 april to 5 april the following year) depends on how much of:. you only pay the rate of income tax on your income in the bracket. The basic rate. Does Your Tax Bracket Change Every Year.

From dxonhtrso.blob.core.windows.net

At What Does Your Tax Bracket Change at Annie Adams blog Does Your Tax Bracket Change Every Year The basic rate (20%), the higher rate (40%),. Uk personal allowance is frozen at £12,570 for. the tax year in the uk stretches from 6 april to 5 april the following year. you only pay the rate of income tax on your income in the bracket. For example, if you earn £52,000 a year, the income tax you’ll. Does Your Tax Bracket Change Every Year.

From blog.turbotax.intuit.com

What is a Tax Bracket? The TurboTax Blog Does Your Tax Bracket Change Every Year you only pay the rate of income tax on your income in the bracket. as announced at spending review 2020, the government will increase the income tax personal allowance and higher rate. For example, if you earn £52,000 a year, the income tax you’ll pay. the income tax thresholds regularly change and any changes are announced in. Does Your Tax Bracket Change Every Year.

From www.theskimm.com

2023 Tax Brackets The Only Changes You Need to Know About theSkimm Does Your Tax Bracket Change Every Year the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. as announced at spending review 2020, the government will increase the income tax personal allowance and higher rate. you only pay the rate of income tax on your income in the bracket. the tax year in the uk stretches from. Does Your Tax Bracket Change Every Year.

From www.bluechippartners.com

What Is My Tax Bracket 2022 Blue Chip Partners Does Your Tax Bracket Change Every Year the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. you only pay the rate of income tax on your income in the bracket. how much income tax someone pays in each tax year (from 6 april to 5 april the following year) depends on how much of:. For example, if. Does Your Tax Bracket Change Every Year.

From medicalvaluations.com

Changes in 2018 Tax Brackets Does Your Tax Bracket Change Every Year as announced at spending review 2020, the government will increase the income tax personal allowance and higher rate. Uk personal allowance is frozen at £12,570 for. the tax year in the uk stretches from 6 april to 5 april the following year. you only pay the rate of income tax on your income in the bracket. . Does Your Tax Bracket Change Every Year.

From www.heritage.org

Analysis of the 2017 Tax Cuts and Jobs Act The Heritage Foundation Does Your Tax Bracket Change Every Year how much income tax someone pays in each tax year (from 6 april to 5 april the following year) depends on how much of:. the tax year in the uk stretches from 6 april to 5 april the following year. Uk personal allowance is frozen at £12,570 for. you only pay the rate of income tax on. Does Your Tax Bracket Change Every Year.

From boxelderconsulting.com

2023 Tax Bracket Changes & IRS Annual Inflation Adjustments Does Your Tax Bracket Change Every Year Uk personal allowance is frozen at £12,570 for. For example, if you earn £52,000 a year, the income tax you’ll pay. the tax year in the uk stretches from 6 april to 5 april the following year. you only pay the rate of income tax on your income in the bracket. how much income tax someone pays. Does Your Tax Bracket Change Every Year.

From marketprosecure.com

Tax Brackets 2020. Complete Guide Taxes, Tax Filling Does Your Tax Bracket Change Every Year Uk personal allowance is frozen at £12,570 for. you only pay the rate of income tax on your income in the bracket. The basic rate (20%), the higher rate (40%),. For example, if you earn £52,000 a year, the income tax you’ll pay. as announced at spending review 2020, the government will increase the income tax personal allowance. Does Your Tax Bracket Change Every Year.

From assetstrategy.com

Tax Brackets 2022 YearEnd Changes To Lower Your Liability Asset Does Your Tax Bracket Change Every Year the income tax thresholds regularly change and any changes are announced in either the chancellor's autumn. Uk personal allowance is frozen at £12,570 for. the tax year in the uk stretches from 6 april to 5 april the following year. The basic rate (20%), the higher rate (40%),. you only pay the rate of income tax on. Does Your Tax Bracket Change Every Year.